1) Progress your debt

A great goal for your 40s should be to eliminate your non-mortgage debt. That means focusing on credit card debt, student loans, car loans, or any other type of consumer debt.

Another debt-related goal is to increase the frequency of your debt repayments. For example, add a second, smaller payment onto your monthly mortgage payment. If you can afford it, you’ll get out of debt quicker.

By focusing on eliminating debt, you’ll increase your credit score, which provides many benefits to your financial life.

2) Earnings and lifestyle

Many Americans hit a career plateau in their 40s and reach the maximum income of their lives. This is fantastic!

But the flipside of higher income is something called “lifestyle creep,” where your increased income directly correlates to increased spending. It’s otherwise known as keeping up with the Joneses.

Instead of spending more, a large portion of any raise should be directed towards financial stability: paying down debt, saving for a rainy day, or investing for the long term.

3) Take advantage of retirement accounts

Many people begin retirement planning in their 40s. As such, we recommend you:

- Maximize any employer matches (a.k.a. free money!), such as the common 401(k) employer matches.

- Utilize both tax-deferred accounts (such as Traditional 401(k) and Traditional IRAs) and tax-free accounts (e.g. Roth accounts), to lower your tax bill both now and in the future.

- Consult with a trusted advisor about the recommended asset allocations within your retirement accounts.

4) Invest outside of retirement accounts

The aforementioned tax-deferred and tax-free accounts provide two sources of personal retirement income. The third leg comes from outside accounts, the most common of which is the taxable account.

Money in a taxable account is far more flexible than in tax-deferred and tax-free accounts, which both have age-based restrictions placed on them.

A taxable account has no age or time restrictions. An important caveat, though, is that any money you earn through capital gains and dividends in a taxable account is subject to capital gains tax.

Proper financial planning will help you balance the investment opportunities and tax liabilities of these various accounts.

5) Think about your home

For most Americans, their primary home represents a significant portion of their net worth. So take care of it! Home maintenance is a classic example of Ben Franklin’s quote “a stitch, in time, saves nine.”

Depending on your family situation, ask yourself questions like:

- Are my housing needs being met?

- Will there come a time when I can/want to downsize?

- Are interest rates and home values beneficial for a refinance? A HELOC? A cash-out refi?

6) Estate planning for you and your parents

Your 40s are an important time for estate planning.

First, you should be thinking about your own family. For many people this age, a will, health care proxy, and power of attorney documentation is sufficient for their estate planning needs. But with sufficient assets, you should consult your advisor or attorney about trusts.

Side note – also make sure to review your beneficiaries as part of estate planning.

Once your estate planning is taken care of, it’s important to ask your parents about their estate plans. Can it be awkward? Potentially. But nowhere near as awkward (and difficult!) as having them pass away without sufficient estate planning, leaving you to navigate their finances at an emotional time.

7) Assess your insurance needs

A general rule for insurance is, “The more people who depend on your income, the more insurance you need.” That’s why people in their 40s, especially those with families, should assess their insurance requirements.

Health, life, disability, and homeowners insurance are important policies to review, ensuring you have adequate coverage.

Our two cents? If you’re unsure, consult an independent fiduciary advisor to review your insurance needs.

8) Save for college expenses

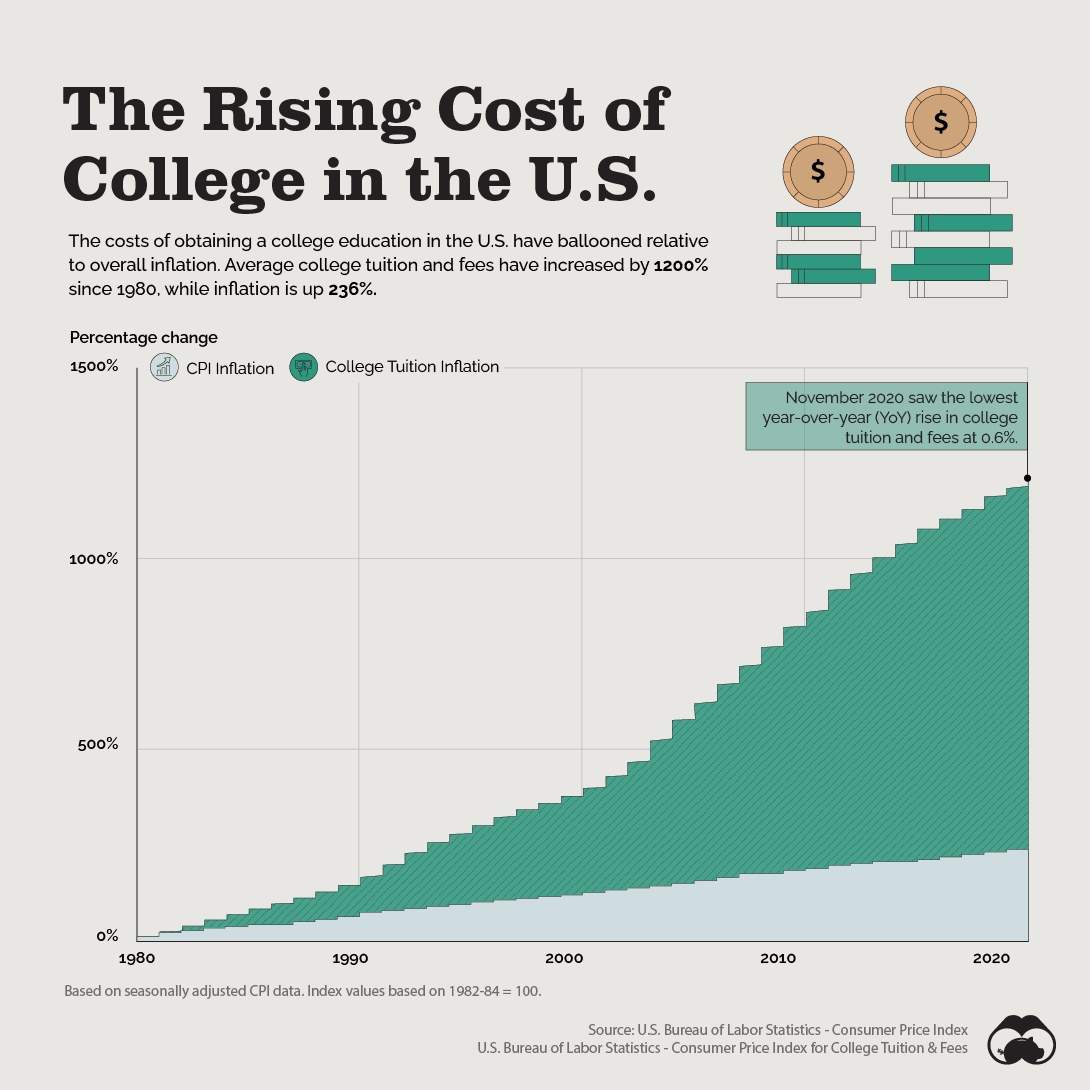

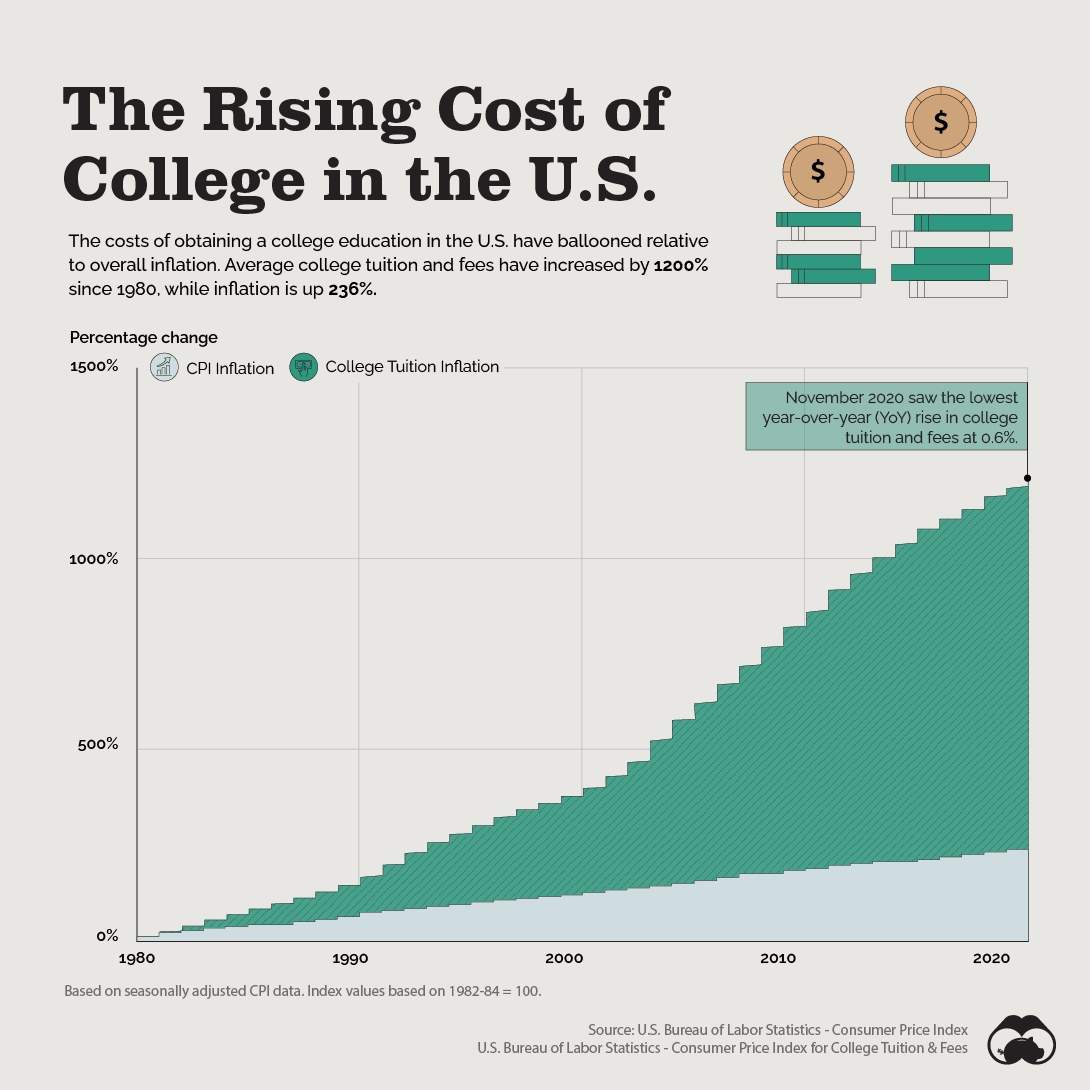

If you have children, there’s a strong possibility they’ll enter college while you’re in your 40s. And if you’re helping them pay for college, start saving now! The cost of college has far outpaced inflation over the past four decades.

Consider funding a 529 College Savings Plan. It’s a tax-advantaged way to save and invest for college.

9) Take care of your health

What’s the point of saving and investing if you spend retirement chronically ill…or worse!? Health is the single most important aspect of an enjoyable retirement.

We won’t lecture you on any specifics—we aren’t fitness or diet experts. But basic principles like proper diet, regular exercise, and medical checkups can help you stay healthy, active, and happy well into your retirement years.

Health and finances share more in common than meets the eye. The decisions you make in your 40s (or any age, for that matter) can have long-term compounding effects.

10) Enjoy your money now

This list mostly covered technical topics like saving, investing, and paying off debt.

But we want to remind you to enjoy your money! Take that trip. Buy that new putter. Spend your hard-earned money in ways you enjoy. As some financial experts opine, “You can’t take it with you!”

Of course, you must balance your current spending against smart planning for the future. You need both.

Just don’t forget to enjoy your money today.

Stay tuned for next month as we take a look at financial tips for people in their 50s. Until then, please don’t hesitate to contact us with any financial planning questions or concerns you may have.

Registration with the SEC should not be construed as an endorsement or an indicator of investment skill, acumen, or experience. Investments in securities are not insured, protected, or guaranteed and may result in loss of income and/or principal. Nothing in this communication is intended to be or should be construed as individualized investment advice. All content is of a general nature and solely for educational, informational, and illustrative purposes.

www.cobblestonecap.com

info@cobblestonecap.com