For example, here’s Chairman Powell in his press conference on November 1st: “the way our policy works is, and sometimes it works with lags of course, which can be long and variable, but ultimately, if you raise the interest rate, you do see those effects.”

Perhaps the most impactful surprise of 2023 was the relentless strength of the US consumer. We’ve been actively following consumer’s relentless strength since September 2022 but now we’re seeing some cracks emerging.

We’re not calling for a major crash, but the consumer is starting to feel the long and variable impacts of monetary policy.

Employment Market Strong but Softening

- Employment is THE most important variable for consumption. People spend money when they have jobs. We are watching employment trends extremely closely.

- After peaking in 2022, job openings are trending downward.

- Will businesses continue hiring?

- When rates were low, many businesses issued debt at low interest rates.

- Over the next few years, this debt will reprice at higher interest rates.

- Higher debt costs will be a headwind for businesses and their hiring plans.

Wage Growth Decelerating

- Wages are growing faster than inflation which helps support consumer spending.

- The Atlanta Fed tracks wage growth which it recently pegged at 5.2% (down from 6.75% in 2022).

- This is above inflation and above consumer’s long-term inflation expectations (most recently 3.2%)

- But as the employment market softens, how long can this continue?

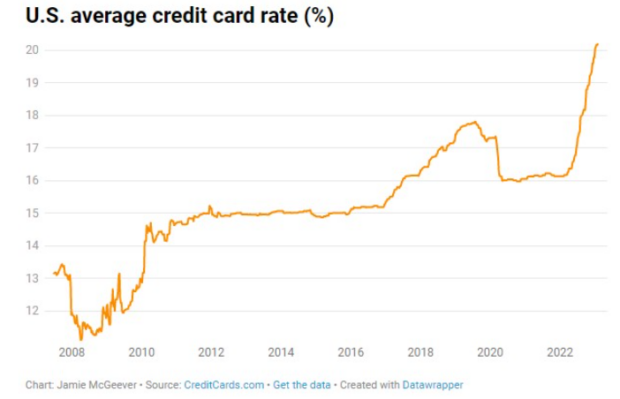

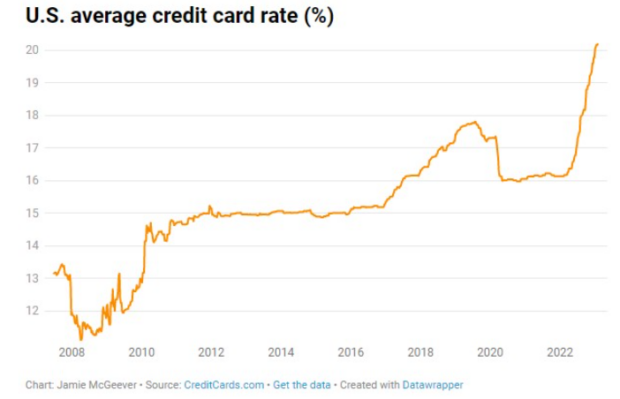

Credit Card Debt

- In the face of inflation, consumers continue to spend money. One of the ways they keep spending is by taking on more credit card debt.

- Outstanding credit card debt is at an all-time high of $1.08 trillion.

- Worse yet, this credit card debt is accumulating interest at a rate 25% above recent levels!

- In early 2022, $850 billion of credit card balances would accumulate interest at a rate of about $136 billion/year.

- Now, $1,080 billion of credit card debt is growing by over $216 billion/year…. A 60% increase in debt servicing costs!

Things should be okay if the job market stays tight but how much more gas does the consumer have left in the tank?

The consumer still hasn’t fully experienced the “long and variable” impacts of monetary policy.