China & Taiwan

Taiwan recently elected Lai Ching-te, a staunch pro-democracy candidate, as president. In response to the election, China’s State Council Taiwan Affairs Office stated, “Taiwan independence” and peace across the Taiwan Strait cannot coexist, as the former is also incompatible with the interests and welfare of Taiwan compatriots.”

Taiwan produces around 90% of the world’s leading-edge semiconductors. Bloomberg Economics pegged the cost of a Taiwan War at around $10 trillion or about 10% of global GDP!

Recently I was speaking with a technology analyst about Taiwan Semiconductor (TSM) and asked him his opinion- His answer was that from a technology standpoint, if Taiwan Semi’s fabs were destroyed, it could set back humanity 10-15 years!

Escalating tensions in the South China Sea are a primary geopolitical risk in 2024.

Russia-Ukraine War

As the stalemate drags on, it seems like we’re slowly gravitating towards negotiated peace. Still, the risk remains that this conflict escalates in some unforeseen way. Could it bring about Putin’s downfall and invite chaos? Could other countries join the fray?

When this war first broke out, we saw how important Ukraine and Russia are for global supply chains as commodity prices spiked dramatically. The economy adjusted but today’s status-quo is not guaranteed.

This war is no longer headline news but the risk of escalation remains.

Israel & Gaza Ramifications

Directly, the Israeli/Hamas conflict is insignificant to global GDP and global financial markets. Indirectly, a conflict in the turbulent Middle East represents a meaningful geopolitical risk.

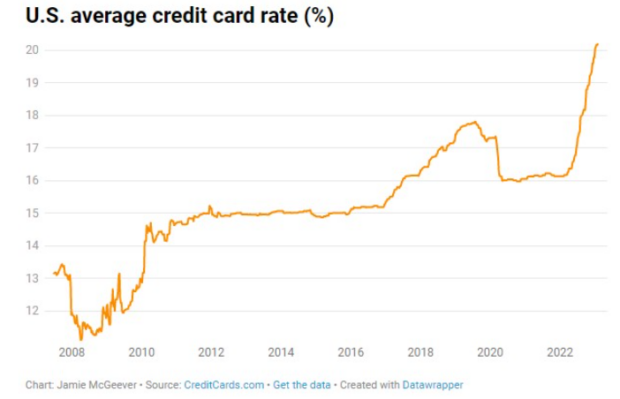

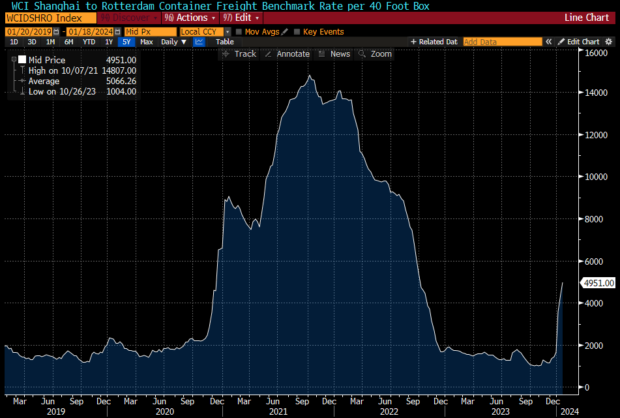

For example, Yemen’s Houthi rebels began launching rockets at any ship bound for Israel. Now they’re simply attacking any ships they can reach in one of the busiest shipping lanes in the world. In response, shipping companies are avoiding the area but this is adding days on to voyage times and putting upward pressure on shipping rates (below).

As a follow-on to the turbulence in Israel, Iran is trying to take advantage of the void and to assert itself as a regional hegemon.

Iran recently launched missiles into Iraq and Syria claiming to strike Israeli intelligence bases. Days later, Iran also provoked its neighbor and fellow nuclear power Pakistan by launching a strike on Pakistani soil.

Ongoing or escalating turbulence in the Middle East is the primary geopolitical risk in the year ahead.

US Foreign Policy

Neoconservative foreign policy culminated in the failures in Iraq and Afghanistan. The result was an overcorrection towards an “America First” style of foreign policy.

As the US takes a less active role around the globe, it presents an opportunity for regional players to exert more influence (like Iran).

The further the US steps back, the higher the risk that a geopolitical event escalates and becomes an issue for investors.

What Didn’t Make the List? (But is Still Making Headlines)

Artificial Intelligence

Eventually, but not in 2024.

Venezuela/Guyana

Venezuela reignited a century-old border dispute with Guyana, seeking to claim more than half of Guyana as Venezuelan territory. Recent oil production for the offshore Stabroek field might have something to do with it.

Why won’t it escalate?

Venezuela can’t even produce the oil reserves that they do have. Perhaps a territorial dispute helps dictator Nicolas Maduro cling to power.

The US and UK have already voiced their opposition to Venezuela taking the land. The US sent defense officials and the UK sent the a warship to Guyana.

No one is helping Venezuela. Even the Chinese want Guyana to remain independent and stable. The Stabroek field is owned by Exxon (45%), Chevron (30%), and the Chinese National Offshore Oil Corp. (CNOOC) (25%).